See This Report about Insurance Code

Wiki Article

The Buzz on Insurance Code

Table of ContentsHow Insurance And Investment can Save You Time, Stress, and Money.Insurance Agent - TruthsThe Best Strategy To Use For Insurance CodeThe 5-Minute Rule for Insurance CommissionThe Definitive Guide to Insurance Asia AwardsExcitement About Insurance Commission

Insurance coverage uses satisfaction against the unanticipated. You can discover a plan to cover almost anything, yet some are more crucial than others. Everything relies on your demands. As you map out your future, these four types of insurance coverage must be strongly on your radar. 1. Automobile Insurance policy Vehicle insurance coverage is important if you drive.Some states also require you to bring accident protection (PIP) and/or uninsured vehicle driver coverage. These protections spend for medical expenditures connected to the case for you and your guests, regardless of that is at mistake. This additionally aids cover hit-and-run crashes and mishaps with chauffeurs that don't have insurance coverage.

Yet if you don't purchase your own, your lending institution can purchase it for you and send you the costs. This might come at a higher cost as well as with much less protection. Home insurance is a good suggestion even if you have actually settled your home loan. That's because it guards you against expenses for residential property damage.

The Of Insurance Account

In the occasion of a burglary, fire, or catastrophe, your occupant's plan should cover many of the costs. It may likewise assist you pay if you have to remain elsewhere while your home is being fixed. Plus, like home insurance policy, occupants offers obligation security. 3. Health Insurance coverage Wellness insurance coverage is one of one of the most essential types.

Rumored Buzz on Insurance Asia

You Might Want Disability Insurance Policy Too "In contrast to what lots of people assume, their house or car is not their greatest property. Instead, it is their capacity to gain an earnings. Yet, several experts do not insure the possibility of an impairment," said John Barnes, CFP and proprietor of My Family members Life Insurance, in an email to The Balance.However you must also think of your demands. Talk with licensed representatives to learn the ideal ways to make these policies benefit you. Financial planners can provide recommendations about other usual sorts of insurance policy that need to also be component of your financial strategy.

Health Insurance What does it cover? Health insurance coverage covers your necessary medical expenses, from medical professional's visits to surgeries. Along with protection for illnesses and injuries, medical insurance covers preventative treatment, such as look at this web-site monthly check-ins and also tests. Do you need it? Medical insurance is perhaps the most crucial kind of insurance policy.

Insurance Asia Awards - Truths

You probably do not need it if Every adult should have medical insurance. Youngsters are generally covered under among their moms and dads' plans. 2. Auto Insurance coverage What does it cover? There are numerous various types of car insurance coverage that Going Here cover different scenarios, including: Obligation: Obligation insurance coverage comes in 2 forms: bodily injury as well as residential property damages obligation.Injury Protection: This sort of protection will certainly cover medical expenditures connected to motorist and also traveler injuries. Collision: Crash insurance policy will cover the expense of the damage to your cars and truck if you enter into a mishap, whether you're at fault or otherwise. Comprehensive: Whereas collision insurance policy only covers damages to your automobile triggered by a mishap, thorough insurance covers any car-related damage, whether it's a tree dropping on your auto or criminal damage from unmanageable community kids.

Always be on the hunt for car insurance price cuts when you're buying a strategy. There are lots of discount rates you might be eligible for to reduce your monthly costs, consisting of safe motorist, married chauffeur, as well as multi-car price cuts. Do you require it? Yes! Every state requires you to have automobile insurance policy if you're going to drive a vehicle - insurance agent.

Our Insurance Asia Awards Ideas

You most likely do not need it if If you don't own a car or have a motorist's certificate, you won't need vehicle insurance. 3. Home Owners or Occupants Insurance What does it cover? House owners insurance covers your home against damages and burglary, in addition to other risks such as damage to a site visitors home, or any kind of expenses if someone was wounded on your building.Nonetheless, you might require extra insurance coverage to cover natural disasters, like flooding, earthquakes, and wildfires. Renters insurance coverage covers you against damage or theft of individual products in a house, and in some cases, your cars and truck. It likewise covers liability prices if a person was wounded in your apartment or condo or if their valuables were damaged or taken from your apartment.

Do you require it? House owners insurance is absolutely vital due to the fact that a home is frequently one's most important possession, and also is often required by your home mortgage lending institution. Not only is your residence covered, yet many of your valuables as well as personal items are covered, too. Renters insurance policy isn't as crucial, unless you have a huge home that has a lot of valuables.

Our Insurance Ads Statements

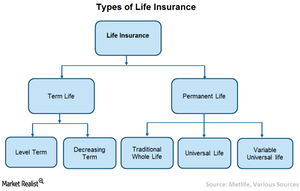

Do you require it? Life insurance coverage is the sort of insurance that the majority of people wish to stay clear of thinking of. It's extremely important. If you have a household, you also have a responsibility to see to it they're attended to on the occasion that you pass before your time, specifically if you have youngsters or if you have a partner that's not working.

Report this wiki page